One is a moving target. The other is nearly a done deal.

By Ramon Lopez

Original Air Date: February 18, 2026

Host: Sarasota County is in the process of buying two high-profile pieces of land in densely populated areas. One—a former golf course the county would like to use to improve stormwater management—still is a moving target. The other one, a boat launch area at the foot of a bridge to Siesta Key, is probably a done deal. Ramon Lopez brings you the details.

Ramon Lopez: For the Sarasota County commissioners, it’s Let’s Make a Deal. To be more specific, let’s make two significant real estate deals. But neither are done deals.

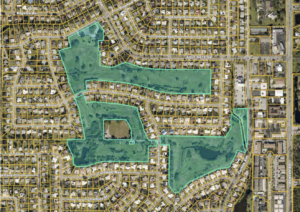

The Gulf Gate golf course property. A developer originally planned to fill it with homes, but is now willing to sell.

Last week, on February 10, the Sarasota County leaders voted 5-0 to move ahead towards buying the old Gulf Gate golf course and put it in public hands. The county would turn it into a preserve to help protect the environment and assist with stormwater management.

The alternative? Allow a real estate developer to convert the abandoned golf course into a new 100 single-family home development.

The Stickney Point bridge boat launch property.

The other deal would authorize Sarasota County to buy a piece of prominent Stickney Point Road property for a total of $21 million. It’s at an entrance to tony Siesta Key with bay frontage, docks, water sport anchorage, a potential ritzy restaurant in the future, as well as a public park.

The latter real estate deal was not unanimous, however, with Commissioner Tom Knight nervous about the deal and voting nay. But fellow commissioner Teresa Mast called the acquisition a “gem.” And Commission Chair Ron Cutsinger said, “You only get one chance to buy a property like this.” More on what’s behind Door Number 2 later in the report.

Development plan detailing the transformation of the Gulf Gate golf course into a 100 single-family home development

Now back to the 49-acre golf course deal. It’s not without issues. A developer holds the rights to transforming it into a 100-home community should the county not acquire the rare chunk of open land.

A year ago, the county leaders asked staff to put together a presentation on the benefits of such a purchase. The study was to also point out any financial and environmental issues.

Those issues include soil contamination from arsenic that will require remediation. Also at issue is negotiating a fair market price. The county appraisal was lower than the asking price. And also at issue is where the county would get the cash to purchase the property.

It’s no secret that Commissioner Joe Neunder backs the purchase, if the pollution and price problems can be resolved.

Joe Neunder. Photo courtesy of Sarasota County

Joe Neunder: Certainly, the testimony today highlights some of the very important factors, including but not limited to—and I’ll keep my comments brief—stormwater mitigation benefits, water quality and quantity issues 0.72 miles from Little Sarasota Bay—I don’t think it’s any secret that I have an affinity towards the water, Midnight Pass and all things related to intercoastal protection of our resource as a coastal community. There’s considerable amount of public support here. I think that the homeowners did a fantastic job articulating the ask, and at this point, it’s a very simple ask.

RL: Neuder made a motion on the matter.

Map indicating the location of the Stickney Point bridge property.

JN: Agenda item 23. I’d like to make a motion to, A, approve, provide policy guidance regarding potential county acquisition and future use of the Gulf Gate golf course property and authorize the county administrator to negotiate a potential purchase and sale agreement with the property owner subject to future board approval in addition to, B, to authorize the County Administrator to engage the services of a qualified third-party engineering firm to analyze the site and develop cost estimates associated with the environmental remediation, including arsenic impacts.

RL: The seller of the Stickney Point property is Big Main Street LLC.

Tom Knight said he was bothered by “unknowns” regarding that real estate transaction.

Tom Knight

Tom Knight: My nervousness is not about the deal. The nervousness is, for me, about what our business plan for the future is and what the concept will be and what the cost factor of all that will come out to be. It’s just a little nebulous for me, and it makes me nervous, this big of a purchase for this much property.

But certainly it’s a great deal. I just don’t want to raise our budget for operations conceptually. We’ve moved some money for different reasons—for different purposes that weren’t anticipated. I don’t want this to be one that is unanticipated—that we’ve got to find money to operate something that wasn’t there two years ago. Not the deal itself. The deal’s solid. I’ve read through it and everything. Certainly the deal with the ownership groups—awesome. I get nervous a little bit about the conceptual business plan—the future. This isn’t just buying an acre and having a house on it. This is big.

RL: The next step towards the property purchase is a due diligence period that runs through May 21, with closing of the deal due by July 10.

This is Ramon Lopez for WSLR News.

WSLR News aims to keep the local community informed with our 1/2 hour local news show, quarterly newspaper and social media feeds. The local news broadcast airs on Wednesdays and Fridays at 6pm.