How does it work?

- The donor requests his or her IRA plan administrator to transfer funds to a charitable organization. (Donor-advised funds, supporting organizations and private foundations, are not included under the provisions. See note below.)

- The IRA administrator transfers funds directly to the charity.

- This “qualified charitable distribution” is excluded from the donor’s adjusted gross income.

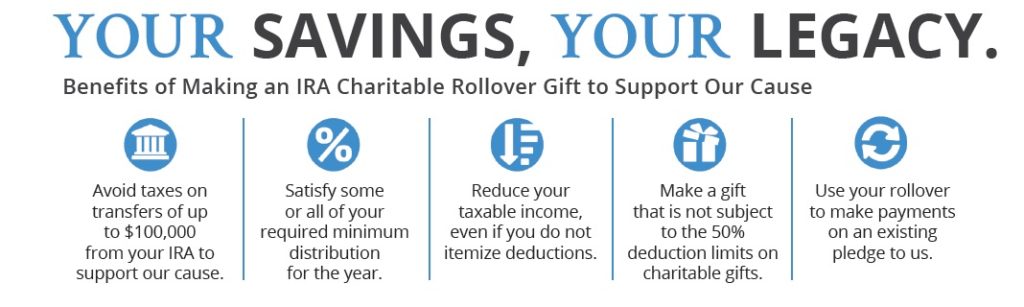

Benefits of the IRA Rollover

- Qualified charitable distributions are excluded from the donor’s adjusted gross income. Note: IRAs may be funded with pre- or post-tax dollars, and assets distributed from IRAs may, accordingly, be taxable or nontaxable. Only IRA distributions that would be included as taxable income if withdrawn by the account holder count as “qualified charitable distributions” and can be excluded from income. If donors choose to distribute nontaxable IRA funds to a charity, they may still be able to claim a charitable tax deduction for the amount of the gift. Prospective donors should consult with tax advisers before making any charitable distributions from IRAs.

- IRA account holders over age 70½ are subject to required distribution rules. Qualified charitable distributions from IRA accounts count toward the owner’s required minimum distributions.

- “Qualified charitable distributions” (i.e., charitable rollovers of funds which can be excluded from a donor’s income) are not included as part of the donor’s maximum allowable charitable tax deductions. This means that IRA rollover gifts do not count toward 50 percent of their adjusted gross income limitation on charitable gifts of cash.

- Required IRA distributions may increase an individual’s adjusted gross income and increase the percentage of Social Security payments on which he or she has to pay tax. By choosing to make a charitable distribution with all or part of their required IRA distribution, donors may reduce income and reduce the percentage of Social Security subject to taxation.

- The IRA rollover allows donors who do not itemize deductions to contribute IRA assets to charities and enjoy tax benefits similar to those derived from claiming itemized charitable deductions.

- Taxpayers in states that do not allow itemized deductions and follow federal income inclusion rules may realize state tax benefits by making charitable qualified distributions from their IRAs.

Important note: This overview of the IRA rollover provision is designed to provide a general understanding of the law and should not be construed as legal, accounting, tax or other professional advice.